How to Check Aadhar Link with PAN ??

Introduction:

The Aadhaar card and PAN card are two crucial identification documents in India. Linking them together can help streamline various financial processes and ensure seamless transactions. In this comprehensive guide, we will walk you through the process of checking the Aadhar Link with PAN. By following these simple steps, you can verify if your Aadhaar card is successfully linked to your PAN card.

1: What is Aadhaar?

Aadhaar is a unique 12-digit identification number issued by the Unique Identification Authority of India (UIDAI). The Aadhaar card functions as a valid form of identification and address verification for residents of India. Aadhaar has become a mandatory document for various financial and government-related services.

2: What is PAN?

PAN, which stands for Permanent Account Number, is a ten-digit alphanumeric code issued by the Income Tax Department of India. It is used for tracking financial transactions, filing income tax returns, and other tax-related purposes. PAN is an essential document for individuals and entities conducting financial activities in India.

3: Importance of Aadhar Link with PAN

Aadhar Link with PAN has numerous benefits, such as:

Elimination of Duplicates: Linking Aadhaar with PAN helps eliminate duplicate or fraudulent PAN cards, ensuring accurate financial records.

Ease of Tax Filing: With the Aadhaar-PAN link, individuals can easily file income tax returns online and avoid any discrepancies in their tax-related information.

Government Subsidies and Schemes: Aadhaar-PAN linkage enables the government to efficiently deliver subsidies, benefits, and welfare schemes to eligible individuals.

4: Steps to Check Aadhaar Link with PAN

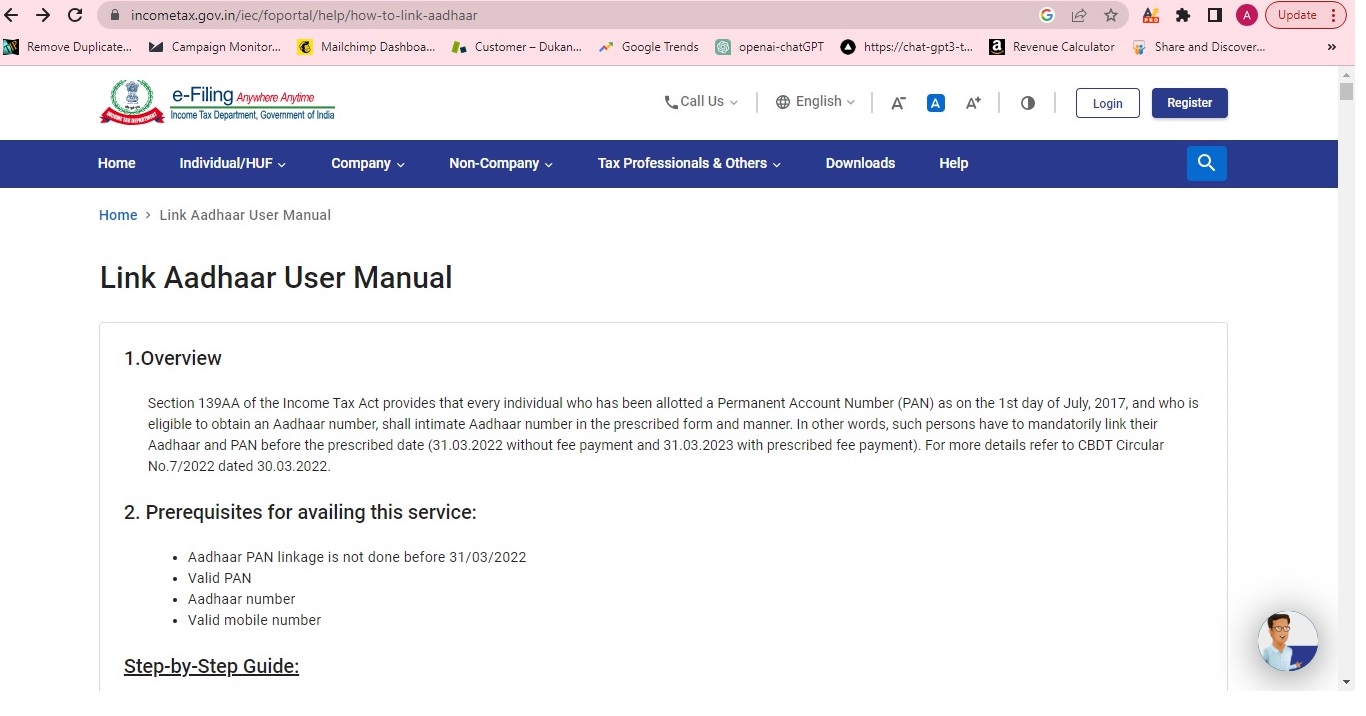

Follow these steps to check if your Aadhaar card is linked with your PAN card:

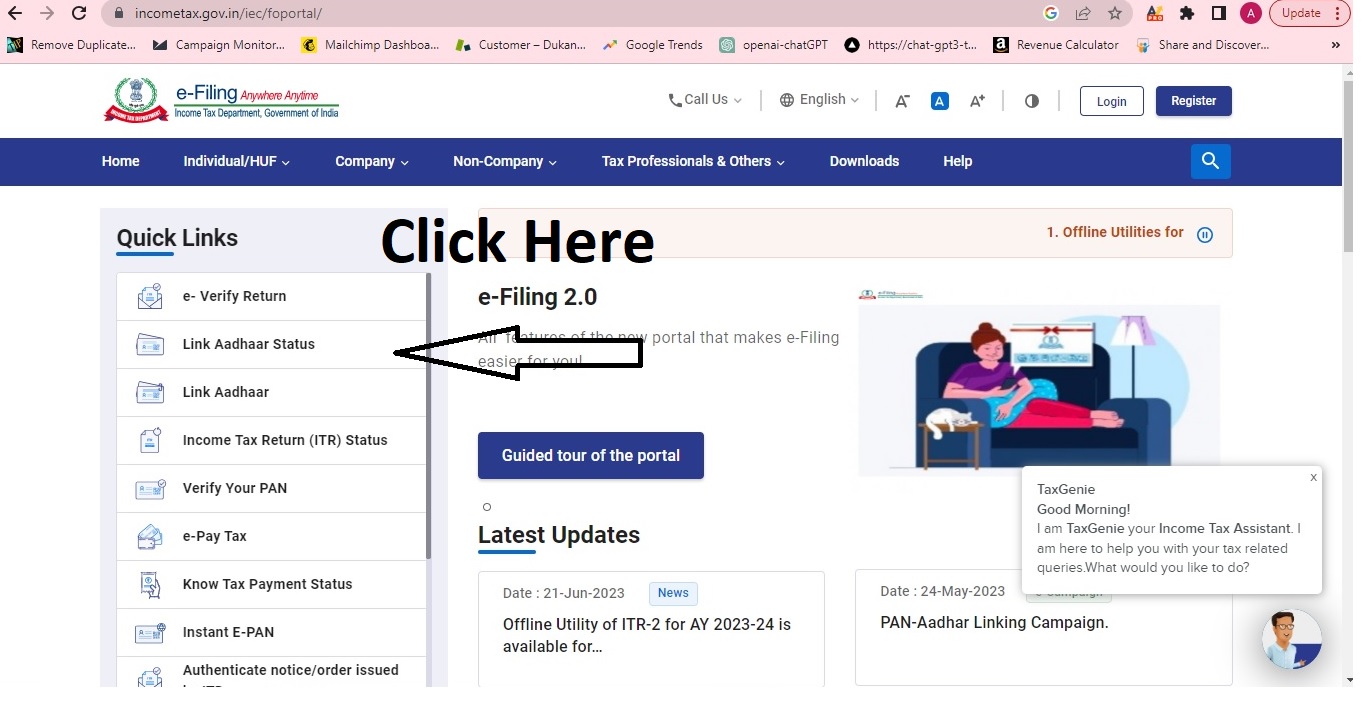

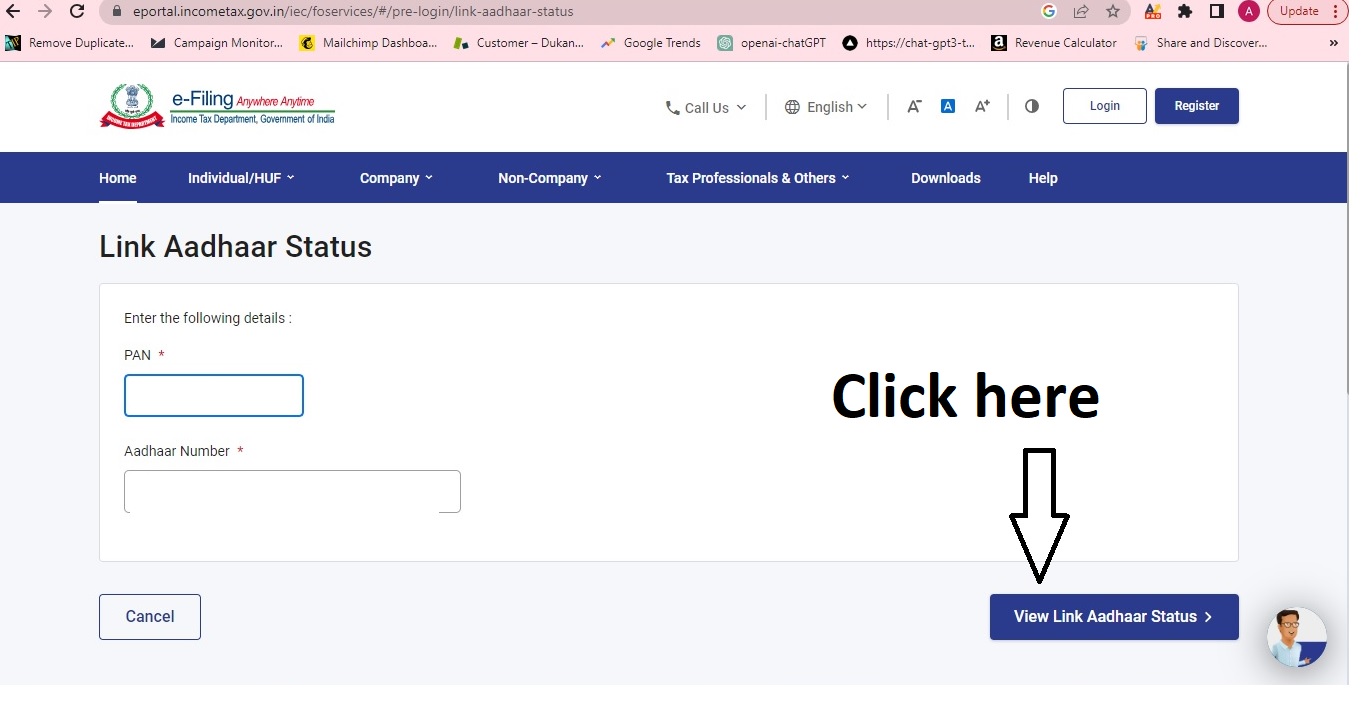

Step 1: Visit the official website

Go to the Income Tax Department’s official website (www.incometaxindiaefiling.gov.in).

Step 2: Locate the ‘Link Aadhaar’ option

Find the ‘Link Aadhaar’ option on the website’s homepage.

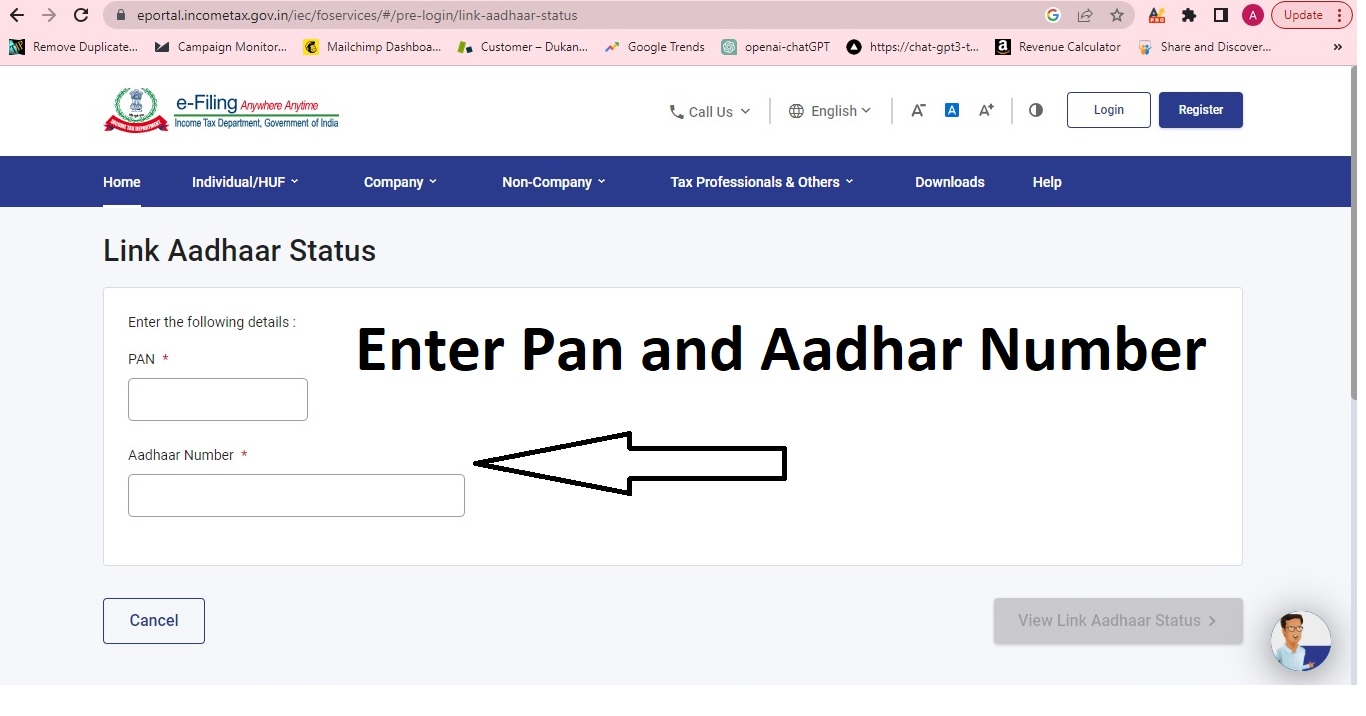

Step 3: Enter your details

Enter the required information, including your PAN number, Aadhaar number, and other relevant details.

Step 4: Click on ‘Aadhaar Link’

After verifying the entered details, click on the ‘Aadhar Link’ button to initiate the verification process.

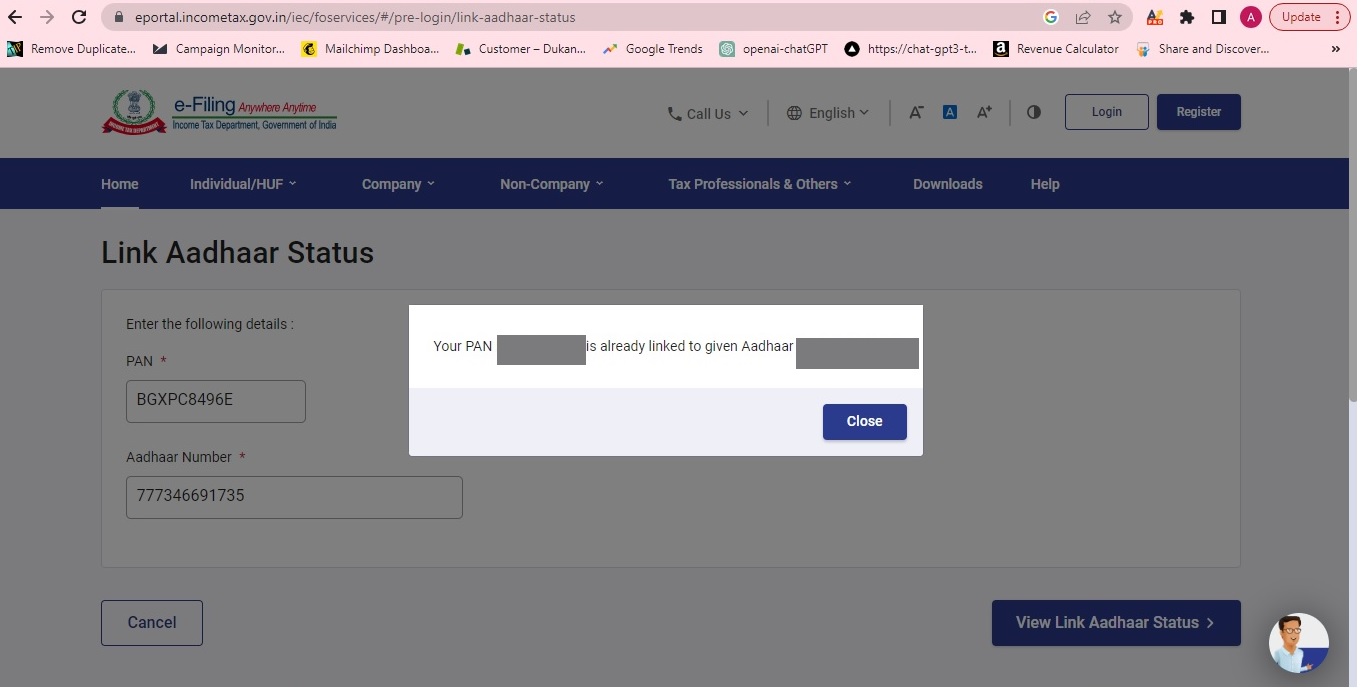

Step 5: Check the status

Once you click on the ‘Aadhar Link’ button, the system will display the status of the Aadhar link with your PAN card.

5: What the Status Indicates

After completing the verification process, you will see one of the following status messages:

Linked: If your Aadhaar is successfully linked with your PAN, the status will display as “Linked.” Congratulations, your linkage is complete!

Not Linked: If your Aadhaar is not linked with your PAN, the status will indicate “Not Linked.” In this case, you may need to recheck the information entered or follow the necessary steps to link them.

6: Troubleshooting Tips

In case you encounter any issues while checking the Aadhaar link with PAN, consider the following troubleshooting tips:

Double-Check the Details: Ensure that you have entered the correct PAN and Aadhaar numbers along with other required information.

Verify the Captcha: Make sure you correctly enter the captcha code to avoid any errors during the verification process.

Contact Support: If you continue to face difficulties or receive an error message, reach out to the Income Tax Department’s helpline or customer support for assistance.

7: Benefits of Aadhaar-PAN Linkage

The Aadhaar-PAN linkage offers various benefits, including:

Faster Tax Refunds: With Aadhar linked to PAN, taxpayers can receive faster and more accurate tax refunds directly into their bank accounts.

Preventing Tax Evasion: Linking Aadhaar and PAN helps authorities track individuals’ financial transactions, reducing the chances of tax evasion.

Easy Verification: The linkage simplifies the process of identity verification and ensures the authenticity of PAN cardholders.

Conclusion:

Verifying the Aadhar link with PAN is an essential step for individuals conducting financial transactions and filing income tax returns in India. By following the step-by-step guide mentioned above, you can easily check the status of your Aadhaar-PAN linkage. Ensuring the successful link between these two important identification documents brings convenience, security, and compliance with government regulations. Stay updated with the latest changes and guidelines provided by the Income Tax Department to ensure a hassle-free financial experience.